Big Data Case Study – unchurn

Posted on May 13, 2021 Big Data Machine Learning & AI

This content was originally published in four parts which have been combined below.

Intro

Big Data Case Study – Banking Sector Machine Learning

Customer retention is of paramount importance in today’s banking industry. Competition abounds due to ever expanding options for consumers. This presents a challenge to maintain customer loyalty. While interventions and incentives can help, how can you ensure you deploy them most efficiently?

Part 1

Data Ownership

Purchasing your transactional data from third party service providers is costly and often does not come with the statistical analysis required to make business decisions. Coanda provides a solution where you do not need to purchase this data to effectively predict customer churn.

Part 2

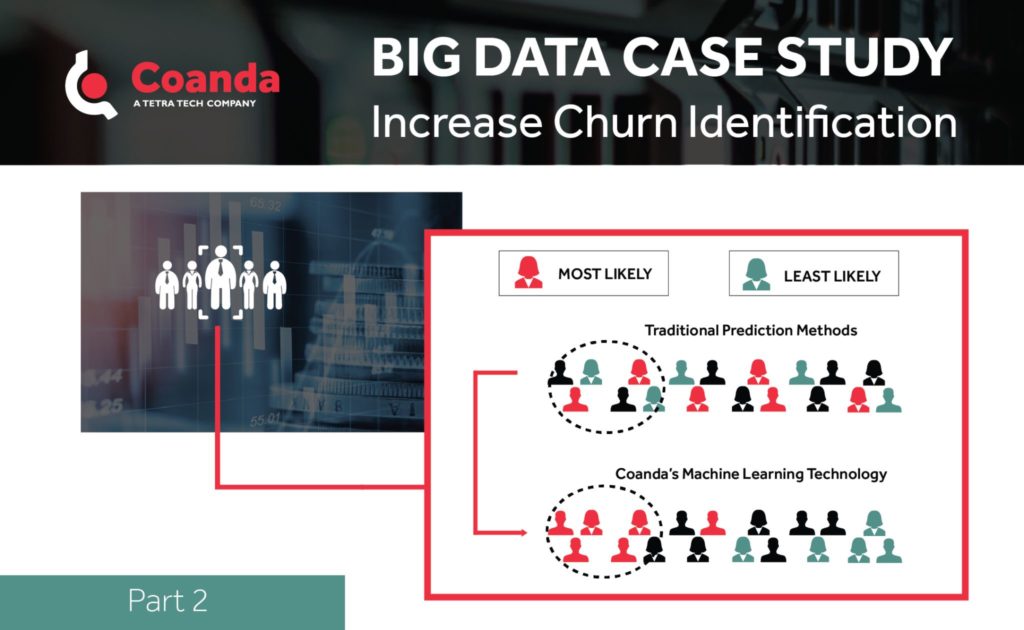

Increase Churn Identification

By using the Coanda algorithms, 120 accounts of the 600 that actually closed over a 3-month period were identified, compared to only identifying 8 using previous methods. By acting on the algorithm predictions, a bank can increase their customer churn reduction by as much as 15 fold.

Part 3

Testimonial

With your customer data in hand, we can employ Machine Learning models and algorithms to identify customers who churn. Our team of data scientists will assess the data that is available, and select the right model to use, to provide a tailored solution to your unique situation.